After a decade of nearly 0% rates, many are rusty in the art of squeezing extra return on cash, if they consider it at all. This is unglamorous until the extra money hits the account, as if you won a local radio station contest. For some clients it is a $100 bill, for others, a $10,000 bill. Yet improving returns without taking extra risk is straightforward with the right cash management process.

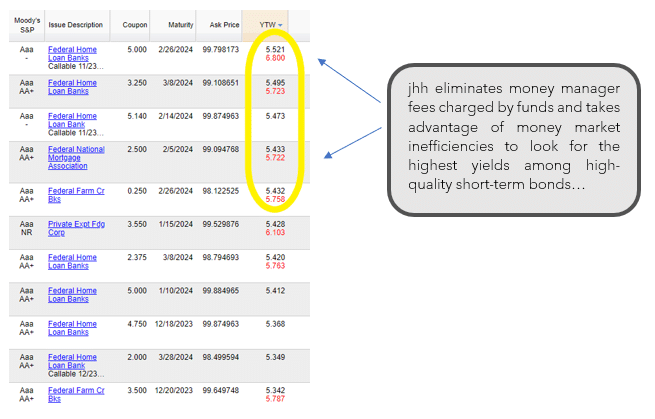

Go beyond set it and forget it for cash management. In a fee sensitive manner, jhh enhances yields by directly purchasing short-term government securities, including agencies, FHLB bonds, and even SBA securities. These are typically on par with our AA rated government yet provide the opportunity to gain 0.30 – 1% higher yields than leading money market funds that have to move billions of dollars and follow tight regulations.

How short-term bond market inefficiencies drive higher yields on cash

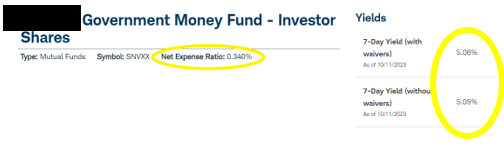

Because of our boutique size, we can take advantage of smaller lots at higher yields for short-term money market instruments. For example, this major money market fund has over $20bn in net assets and must abide by strict regulation, which limits their flexibility and effectiveness as an enhanced yield cash management strategy:

Above also shows how money market funds will charge a fee, and many investors are often charged an additional fee by their advisor. This can create multi layered fee drag on the potential return. jhh cuts out the excess fees from the money market fund and provides cash management directly, where we selectively look for higher yielding bonds:

(The above is for illustrative purposes only. Past results no guarantee of future returns.)

With just an additional 0.15% to 0.20% of annual yield, a $10,000,000 allocation can generate an additional $15,000 to $20,000 annually when compared to typical money market funds.

For those not utilizing a cash management strategy at all, achieving a 5% annualized return on a cash allocation of $500,000 would deliver a return of $25,000 annually.

How to improve your cash management?

The account is in your name at an approved custodian such as Interactive Brokers, RBC, or Schwab. Subject to minimums, jhh works with your preferences to achieve rates approaching 6% in a cash-only account or works in a fee-efficient manner to manage a cash concentration within a diversified portfolio. If you hold a significant cash position, we encourage you to contact us today for advice on ways to unlock a better cash management strategy.

Disclosure

Values, calculations and information are obtained from sources believed to be reliable; however, jhh wealth, llc does not guarantee its accuracy and completeness and is not responsible for any errors or omissions.

Advisory services are offered through jhh wealth, llc, a Registered Investment Advisor. An investment advisory disclosure document jhh wealth, llc that describes our firm’s services, pricing, conflicts of interest, and other matters is available at no cost to you. This type of document is also available for any investment advisors managing your account. Please ask us if you would like a copy of these documents. Some investments, including but not limited to Mutual Funds, Exchange Traded Funds, Separately Managed Accounts and Private Investments may be categorized and labeled herein by asset class, style and/or strategy based on third party sources and/or jhh wealth, llc own proprietary evaluations. These labels are generalizations and are not meant to suggest that the entire holdings of a particular investment should be considered as representative of the investment’s broad label.

Performance data reported herein represents past performance and does not guarantee future results. The investment return and principal of an investment will fluctuate so that when redeemed, the value may be worth more or less than original cost. Portfolio level returns are presented net of all fees. All returns are annualized for periods greater than one year. Annualized returns represent the geometric, compounded return for the period shown. The indices, benchmarks, ETFs or other vehicles reported herein for comparative purposes are not the only potential benchmarks for evaluating the performance of an individual investment or portfolio. Depending upon the holdings in your portfolio, your investment objectives, and your risk temperament, it may be more appropriate to measure performance against other benchmarks, or some combination of several benchmarks. Economic factors, market conditions, and investment strategies will affect the performance of any portfolio and there are no assurances that it will match or outperform any particular benchmark.

Returns were calculated using a Time Weighted formula. Time weighted return is useful for comparing the investment performance of a manager to a benchmark and ignoring cash flows that are beyond the control of the investment manager. Risk measurement, volatility, and preservation of purchasing power are important considerations and should be discussed with your Advisor. If you have any questions about any terms used within this report, please contact your Advisor.

It is important that you periodically review your portfolio and financial circumstances with your advisor. If there are any changes to your goals or financial profile, it is essential that you contact your advisor, at any time of the year, in order to discuss your state of affairs or to update your profile.